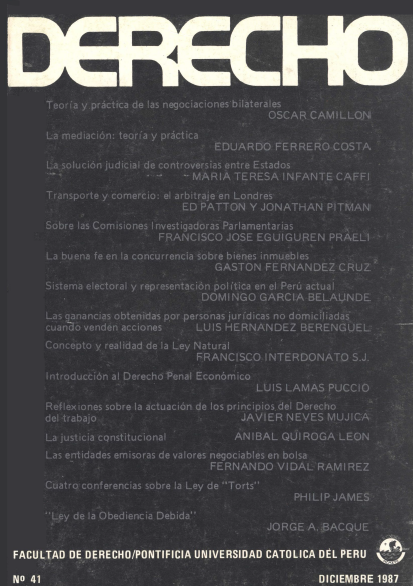

Entities Issuing Securities Negotiable on the Stock Exchange

DOI:

https://doi.org/10.18800/derechopucp.198701.013Keywords:

Issues, legal entities, shareholders, capital stock, financing, bonds, shares, equity interestAbstract

The text analyzes the characteristics and regulation of entities issuing publicly traded securities in Peru, highlighting their importance within the financial market. It explains that these issues are reserved exclusively for legal entities, including public sector entities (state-owned companies under public, private and mixed law), as well as private sector corporations. In particular, the author points out that public companies generate share certificates that reflect their capital stock, while private companies use the public offering of shares as a mechanism to obtain financing and promote shareholding. In turn, publicly traded companies, characterized by their listing on the stock exchange, play a crucial role in mobilizing domestic savings and boosting the stock market. Next, it is commented that current legislation contemplates instruments such as convertible bonds and non-voting shares, which diversify financing alternatives. Finally, the need for a more robust regulatory framework to guarantee transparency and safeguard shareholders' interests is emphasized.

Downloads

References

Gubbins, M. (1987). La sociedad anónima abierta en la ley general de sociedades [Tesis de Bachiller, Pontificia Universidad Católica del Perú – PUCP].

Iglesias, J. (1962). Derecho romano: instituciones de derecho privado (4.ª ed.). Editorial Ariel.

Memoria de la 11° Asamblea General FIABV, Rosario, Tomo II.

Montoya, U. (1961). Sociedades anónimas.

Morles, A. (s/f). Curso de derecho mercantil (Tomo II).

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2016 Derecho PUCP

This work is licensed under a Creative Commons Attribution 4.0 International License.